- The Stacker Report: Your Source For Silver Market Insights

- Posts

- Friday’s Sell-Off Set the Stage for Silver’s Next Big Move

Friday’s Sell-Off Set the Stage for Silver’s Next Big Move

Why this pullback looks more like opportunity than exhaustion.

Silver’s Breakout Holds Strong — What Friday’s Pullback Really Means

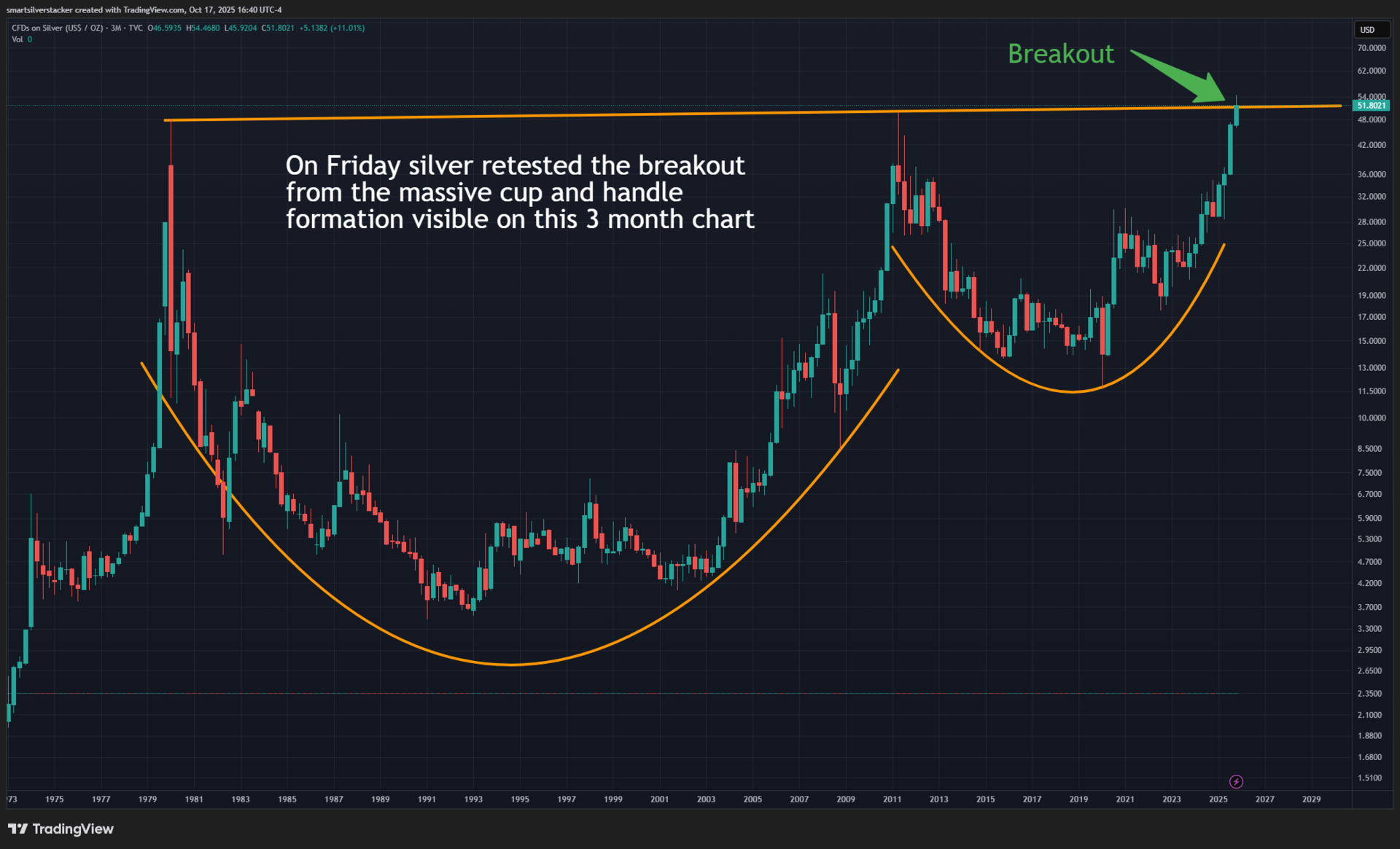

Silver’s sharp sell-off on Friday rattled some nerves, but big picture—it looks like a healthy retest. After breaking out from a multi-decade cup-and-handle pattern, silver gave back some gains but still managed to close above that key breakout line. In other words, support held. Historically, that kind of move often signals the start of a new advance, not the end of one.

Silver has finally broken out of it’s massive long term cup and handle

A Technical Reset, Not a Breakdown

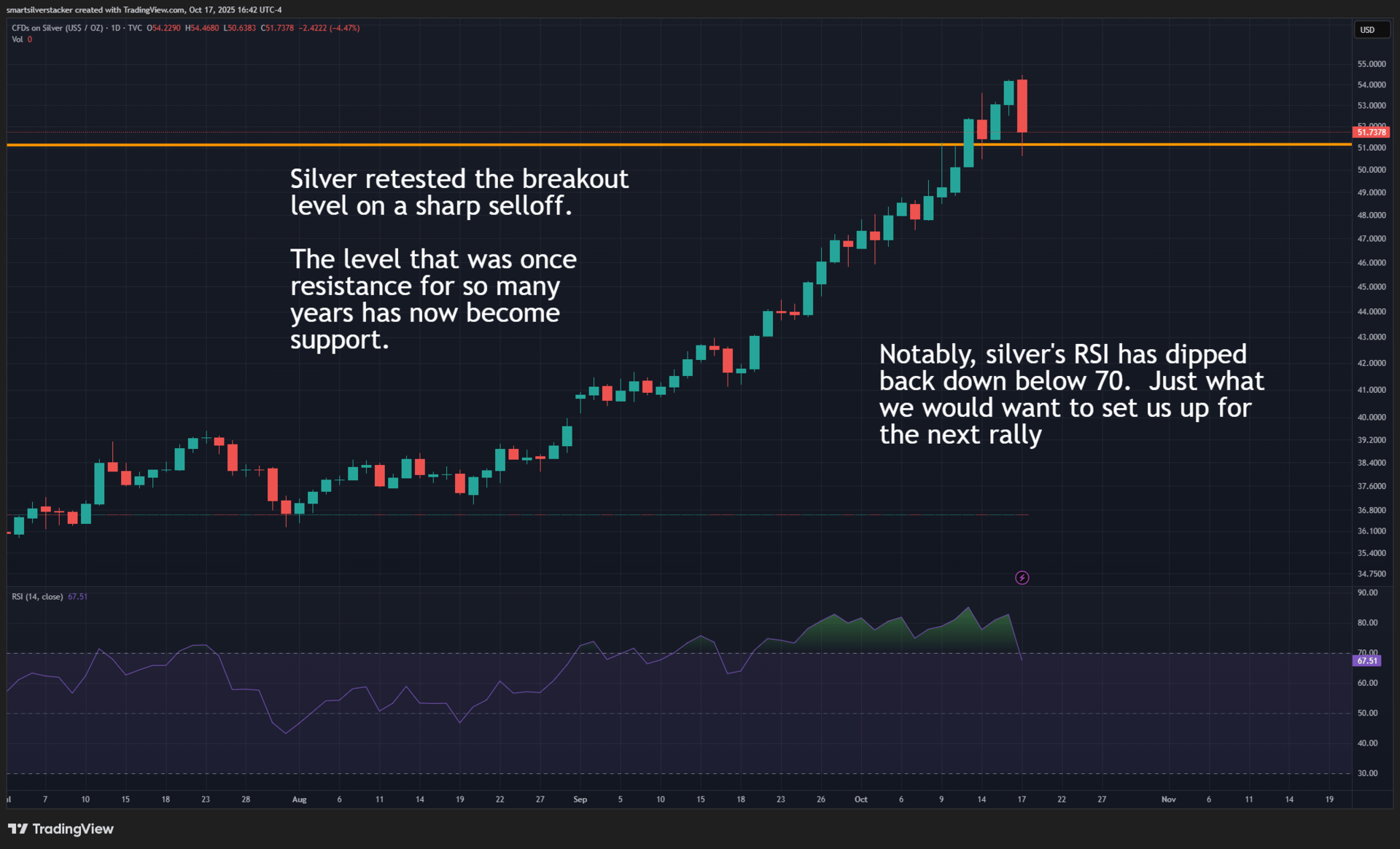

Friday’s pullback took silver down about 4%, cooling off momentum after a strong run. On the charts, that dip looks like a classic breakout retest—the kind of short-term correction that shakes out weak hands before the next move higher. Silver’s RSI has reset from overbought levels, giving the market room to run again.

Friday’s selloff was a healthy retest of the breakout level. RSI is back under 70, setting the stage for the next move higher.

The Macro Shift

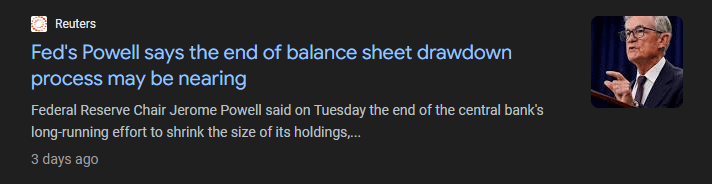

Meanwhile, Fed Chair Jerome Powell hinted this week that quantitative tightening may soon end, acknowledging a softer labor market and “balanced risks.” That’s Fedspeak for a potential pivot—and historically, those pivots have been rocket fuel for gold and silver. Add in renewed stress in the regional banking sector and you have the makings of another round of liquidity support. Each time the Fed steps in, the balance sheet expands—and so does the long-term case for hard assets.

A dovish Powell says QT ending, and acknowledged a softer labor market. Cue the money printer.

Physical and Institutional Tightness

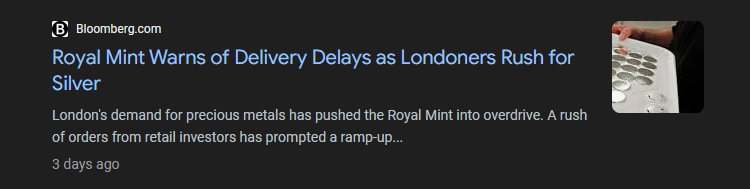

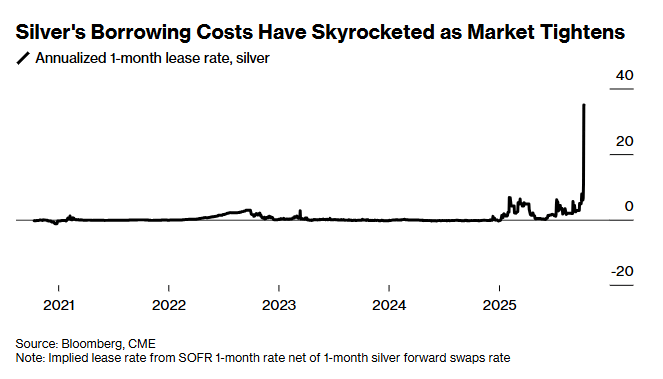

Physical markets are also flashing red for supply. Bloomberg reports that the Royal Mint in London is warning of delivery delays as global demand surges. Vaults in London are running thin, with some silver being flown in from New York to fill orders. Meanwhile, the cost of borrowing silver has soared to record levels—another sign of stress beneath the surface. This is why it is so critical to own physical metal before a crisis or shortages takes place. It’s a game of musical chairs and only so much physical to go around.

Silver is becoming scarce in London

As a result silver lease rates have soared to unprecedented levels.

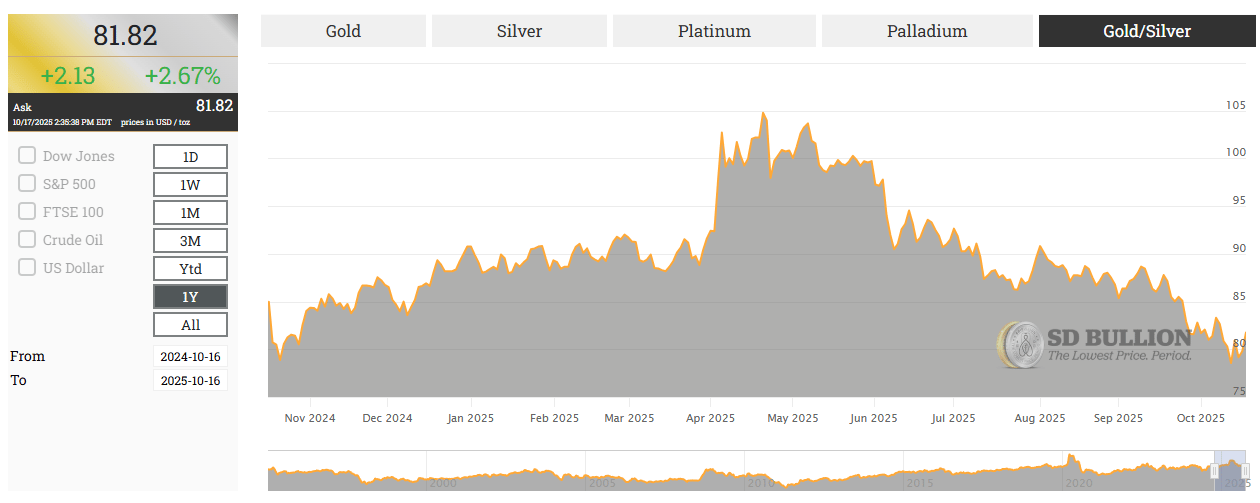

Silver vs. Gold: Room to Run

Even at record highs, silver still looks inexpensive relative to gold. The gold-to-silver ratio remains above 80, a level usually seen at the beginning of bull markets, not the end. During silver’s 2011 run, that ratio fell into the 30s. If history rhymes, there’s plenty of upside left.

An elevated GSR suggests the bull market has not peaked

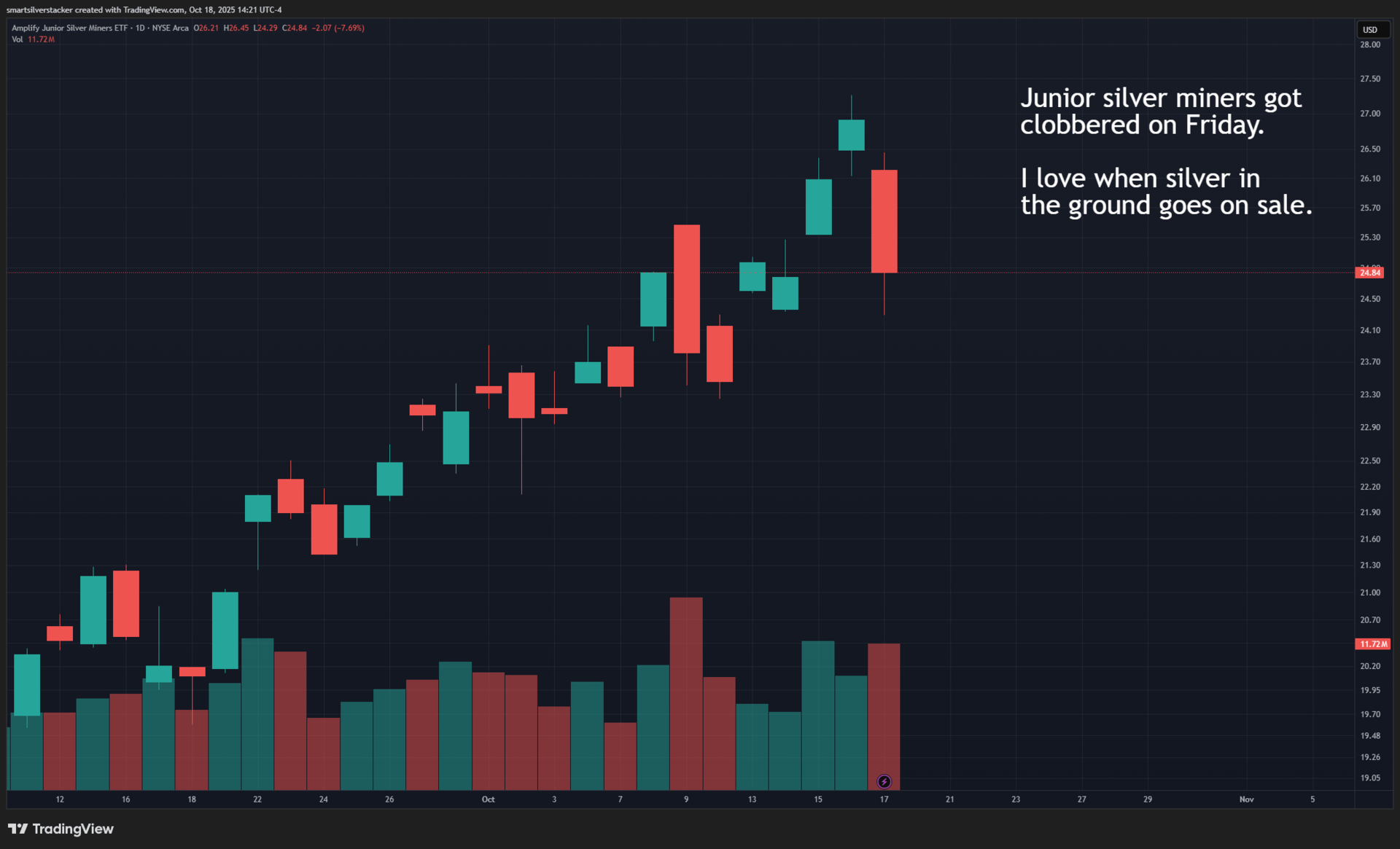

Miners Under Pressure — For Now

Silver miners took an even harder hit on Friday. The SILJ ETF, which tracks junior silver miners, dropped more than 7%. Moves like that can sting in the short term but often set up long-term opportunity. If silver holds its breakout, the miners—being leveraged to the metal—could rebound sharply.

I love when silver in the ground goes on sale like it did on Friday.

Bottom Line

This pullback looks more like a shakeout than a reversal. With silver confirming its breakout, the Fed signaling a policy shift, and physical markets showing clear strain, the broader trend still points higher.

Friday’s sell-off may have been the last chance to buy before silver’s next big move.

Stay safe and happy stacking,

Smart Silver Stacker

⚠️ Not financial advice. For informational and educational purposes only.