- The Stacker Report: Your Source For Silver Market Insights

- Posts

- We Nailed the SILJ Breakout — Here’s What’s Next for Silver

We Nailed the SILJ Breakout — Here’s What’s Next for Silver

Junior Silver Mining Stocks Have Surged

The Breakout We Called – And the Payoff

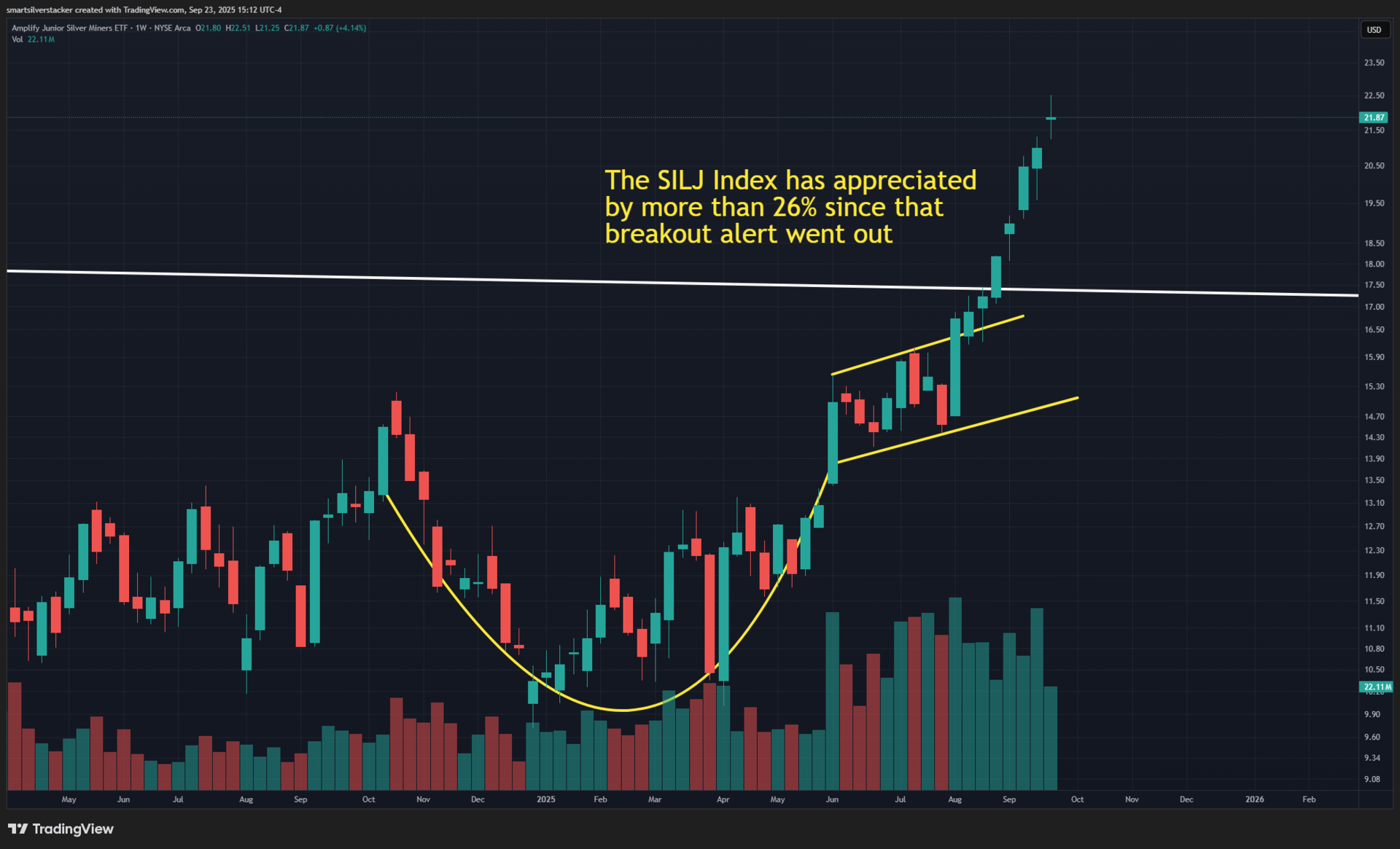

A month ago, I issued a breakout alert on junior silver miners (SILJ). Since that time, SILJ has rallied more than 26%. In this update, you’ll see the original chart alongside the updated version showing just how far this move has gone. If you haven’t yet read that original analysis, you can check it out here: https://smartsilverstacker.beehiiv.com/p/silver-miner-breakout-alert-you-ve-got-to-see-this-chart

This chart of the SILJ ETF was posted in last month’s newsletter, forecasting an imminent run higher

Since that time the ETF is up more than 26%

This kind of move is why we watch the setup early. By recognizing the pattern and the forces driving it, we were able to anticipate this rally well in advance.

Silver Hits $44 – But Expect a Stair-Step Move

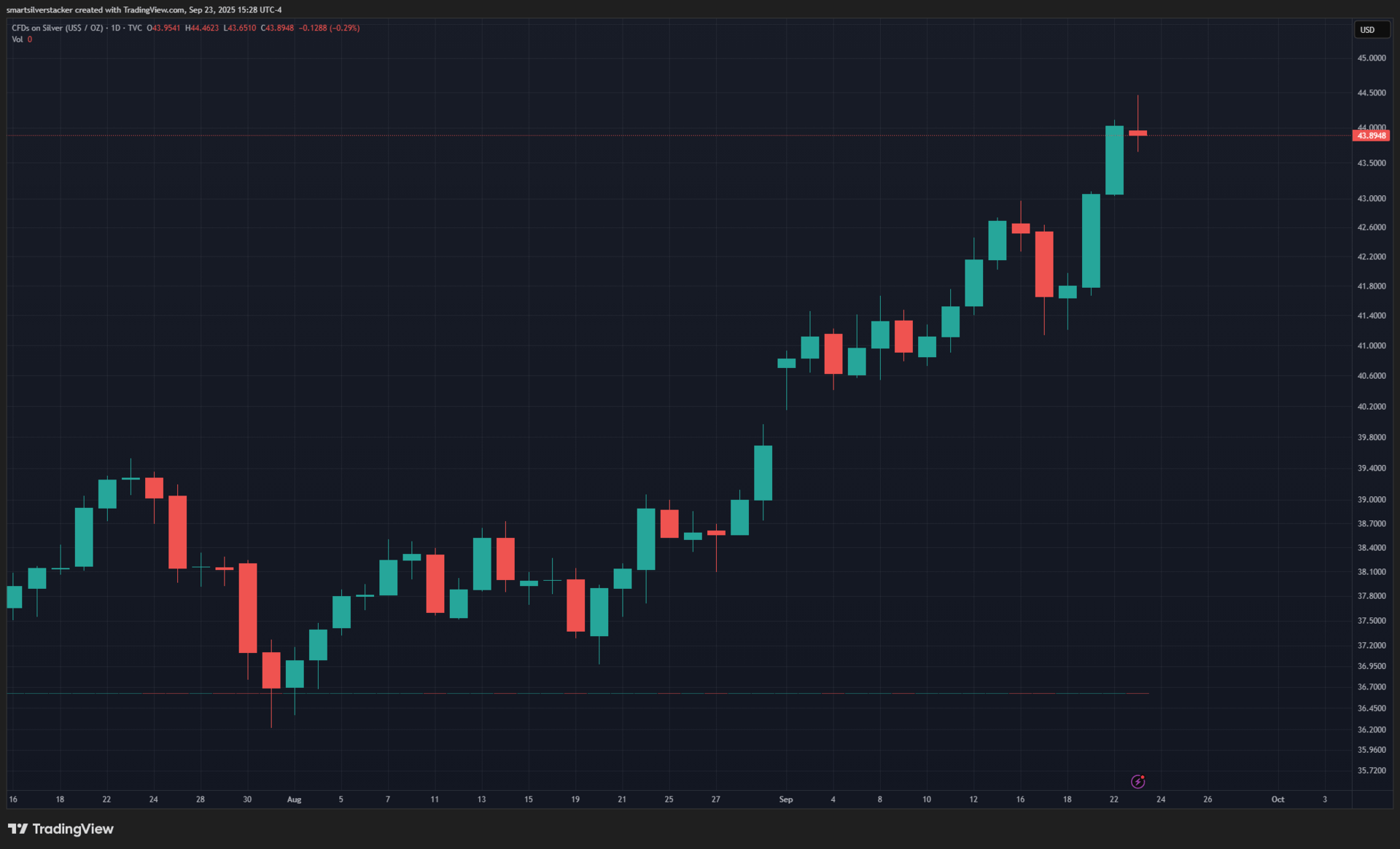

Silver itself recently broke through the $44 level, briefly hitting around $44.46 before easing back slightly. In the very short term, this run looks a bit extended, and a pullback here would be natural after such a steep move.

A pullback in the Silver price would be natural after the run of the past several sessions.

Throughout this bull market, silver and the miners have advanced in a stair-step pattern—sharp rallies followed by orderly consolidations. I expect that trend to continue. We’re not seeing blow-off-top behavior yet. When we do approach a genuine top, I would expect an almost uninterrupted parabolic run, which we haven’t seen.

For now, dips should be viewed as opportunities to add exposure to high-quality positions. Despite some near-term froth, I believe we’re still early in this cycle.

Gold-to-Silver Ratio Remains Elevated

The gold-to-silver ratio remains above 80, which is historically high and a strong sign that silver’s bull market likely has much further to run. During previous cycles, this ratio compressed dramatically as the bull matured. We’re nowhere near that phase yet.

Institutional Money Is Finally Noticing

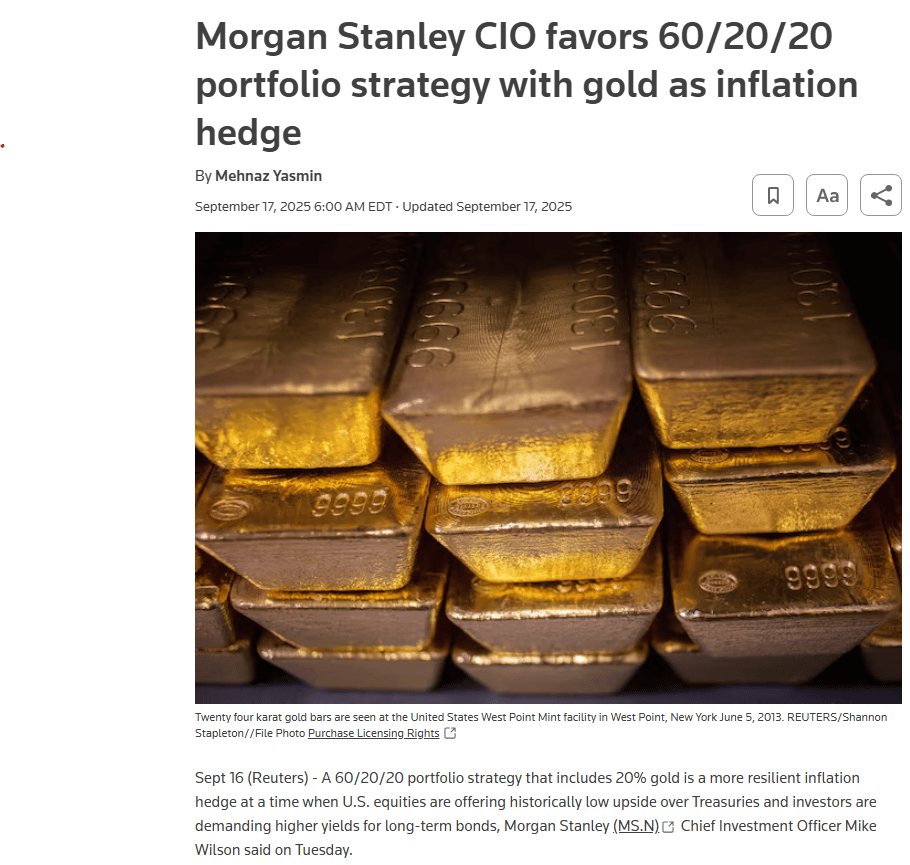

We’re beginning to see institutional players acknowledge precious metals in a way we haven’t in years. Morgan Stanley’s CIO recently highlighted a 60/20/20 portfolio allocation—dedicating 20% to gold—as an inflation hedge and defensive move in today’s market environment. This is a major signal that institutional capital is warming up to metals.

Morgan Stanley CIO now suggests 20% allocation to gold as an inflation hedge

Meanwhile, retail interest in precious metals remains relatively modest. When retail enthusiasm picks up and new inflows surge into the space, the combination of institutional and retail demand could drive the metals and miners much higher.

The Fed and the Policy Shift Ahead

Another critical development: new Federal Reserve board member Stephen Miran—formerly one of President Trump’s chief economic advisers—gave his first Fed speech calling for dramatically lower interest rates. He stated that the federal funds rate should be around 2.5%, significantly lower than current levels. He also warned that current policy risks the Fed’s mandate to maintain full employment.

Stephen Miran sets the stage for a Federal Reserve scapegoat in the case of a recession

This rhetoric is laying the groundwork for a policy pivot. If we enter a recession or a broader economic pullback, the political narrative will frame restrictive monetary policy as the culprit and propose aggressive easing as the solution. That likely means not only lower rates but potentially a return to direct Treasury purchases (QE) by the Federal Reserve.

Loose monetary policy of that magnitude would be profoundly bullish for precious metals.

The Bottom Line

The metals and miners have had a spectacular run, but the macro backdrop suggests this is still just the early innings. We’ve seen the breakout we anticipated in SILJ and a strong move in silver, but we’re far from a true top.

Pullbacks from here should be seen as opportunities to position for the next leg higher. Between institutional adoption, still-muted retail participation, and a potential pivot from the Federal Reserve, the conditions are aligning for a powerful continuation of the bull market in precious metals.

Stay tuned for more analysis and timely alerts as this cycle unfolds.

Disclaimer: This newsletter is for informational and educational purposes only and does not constitute financial advice. Always conduct your own due diligence before making investment decisions.